Amazon posts fifth straight profit on Prime, cloud strength

SAN FRANCISCO — Amazon said late Thursday strong demand for its e-commerce services and cloud business lifted second quarter sales, helping it breeze past Wall Street estimates and pushing shares to another record high.

Sales rose 31% to $30.4 billion. Net income surged to $857 million, or $1.78 a share, up a whopping nine times from a year ago.

Analysts polled by S&P Global Market Intelligence forecast the company would report revenue of $29 billion, with adjusted earnings per share of $1.12, and investors were primed for an even bigger rise after strong results in the past quarter.

For the current quarter, Amazon forecast sales between $31.0 billion and $33.5 billion, an increase of 22% and 32% compared with third quarter 2015. Analysts were expecting $31.7 billion, less than the median of Amazon's range.

Earnings for Amazon were unsurprising given the success the company had over the last several quarters, Natalie Kotlyar, partner at BDO USA’s Consumer Business practice, said.

Kotlyar said the expansions the company has undertaken geographically and into various services shows “they are trying to become the provider of choice for their customers in every single aspect of their lives.”

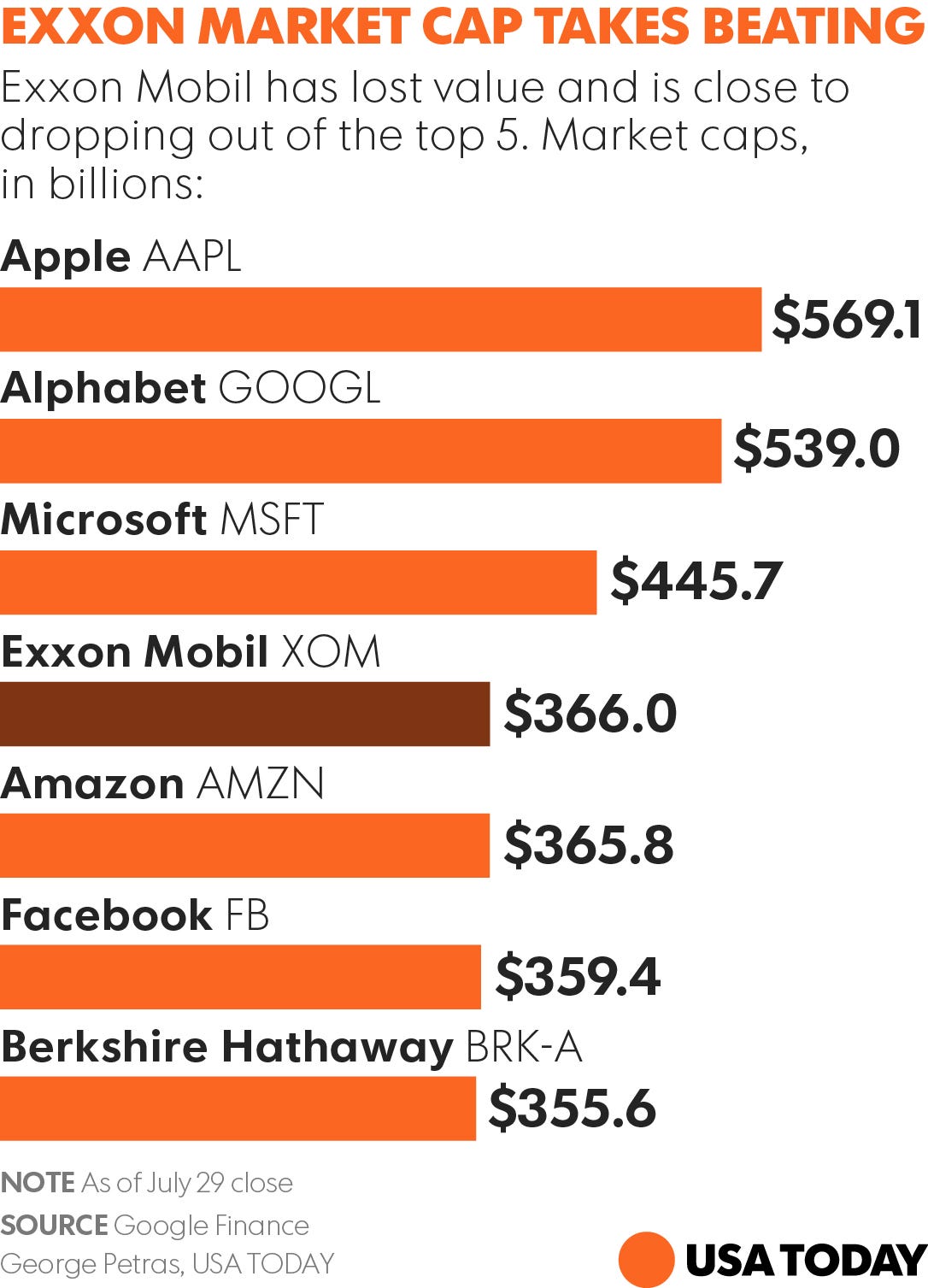

Amazon (AMZN) shares rose 1% to $764.30. Shares are up 40% in the last year.

The Seattle-based e-commerce company is showing shareholders it's continuing to find new areas to grow, such as through launching Prime Day, said Christian Magoon, CEO of Amplify Investments.

Earlier this month, at one of the slowest times of the year for retailers, Amazon held its second annual Prime Day, a sales day for members of its free-shipping and entertainment service. Prime Day orders rose 50% in the U.S. compared to 2015, Amazon has said. Results weren't reflected in Thursday's financial statements, which were for the three months ended June 30.

The success of this year's Prime Day may also suggest an increase in Prime membership, though Brian Olsavsky, the company's chief financial officer, would not disclose exact figures in a conference call to investors.

Prime membership is crucial for the company because it captures a customer's long-term dependence on Amazon for finding goods, as opposed to searching on Google or at a traditional retailer, said Jared Wiesel, a partner at pricing and revenue management consulting firm Revenue Analytics.

"From a retail perspective, it’s really about attracting and retaining prime members to really earn the customer share of wallet and really defend it from other traditional retailers that are competing for it," Wiesel said.

Overall, sales within North America made up most of Amazon's net revenue at 58%. International sales grew 30% over the last year, compared to a slightly lower 28% growth in North America.

In cloud computing, Amazon competes with fellow tech giants like Microsoft and Google, which contrasts with the e-commerce market they have dominated in the U.S.

Amazon Web Services earned $718 million in profit on $2.89 billion in sales, a 58% increase in sales. That's a slight decrease in growth from the first quarter, when the cloud computing unit's revenue increased 64% year-over-year.

"The fact they beat is good, but they did not beat by a ton," Magoon said. "Whether or not that can be a continued source of strong growth, given that there’s been increased competition which means lower margins for that business, I think that’s something that weighs on the stock as a worry."